Other/Investment

Other/Investment

2025/12/12

What Is ECOWAS? Understanding the Purpose of West African Integration and Its Evolving Challenges

What Is ECOWAS?

ECOWAS is a regional political and economic union formed in 1975 to promote cooperation among West African countries. Its initial mission was to create a unified economic space by reducing trade barriers and fostering cross-border commerce.

Over time, the organization expanded its scope to include political stability, peacekeeping, and security cooperation. It now plays a broader role in conflict mediation, election monitoring, and facilitating the free movement of people and goods.

Headquartered in Abuja, Nigeria, ECOWAS traditionally included 15 member states, though recent political developments have reduced active membership.

Integration Goals — Economic Cooperation and Security

ECOWAS aims to strengthen regional economies through shared markets, infrastructure, and long-term strategies such as the introduction of a common currency, the ECO.

Alongside economic cooperation, ECOWAS has become a significant actor in regional security. It has intervened during periods of political instability, offering mediation and enforcing sanctions when necessary to uphold democratic principles.

Challenges — Political Upheaval and Regional Realignment

In recent years, West Africa has experienced multiple coups and political crises. As a result, Mali, Niger, and Burkina Faso withdrew from ECOWAS and established a new alliance, the "Sahel Coalition," signaling a major realignment in the region.

Their departure highlights tensions between ECOWAS’s governance principles and the political realities within certain member states. This shift has challenged the bloc’s ability to maintain cohesion and ensure regional stability.

At the same time, ECOWAS faces broader issues such as extremist violence, climate impacts, and economic disparities — factors that complicate its mission and test its resilience.

Nigeria’s Strategic Role

Nigeria, the region’s most populous and economically powerful nation, plays a crucial leadership role within ECOWAS. It supports peacekeeping operations, influences economic initiatives, and often acts as a mediator.

However, Nigeria’s own internal challenges mean that its stability — or instability — can significantly affect the entire West African region.

The Future of ECOWAS — Between Cooperation and Reality

ECOWAS represents one of Africa’s most ambitious regional integration projects. Yet its future depends on balancing collective goals with the diverse political landscapes of its members.

To remain effective, ECOWAS will need to reinforce both economic integration and political stability, ensuring that cooperation continues despite mounting regional challenges.

Other/Investment

Other/Investment

2025/12/11

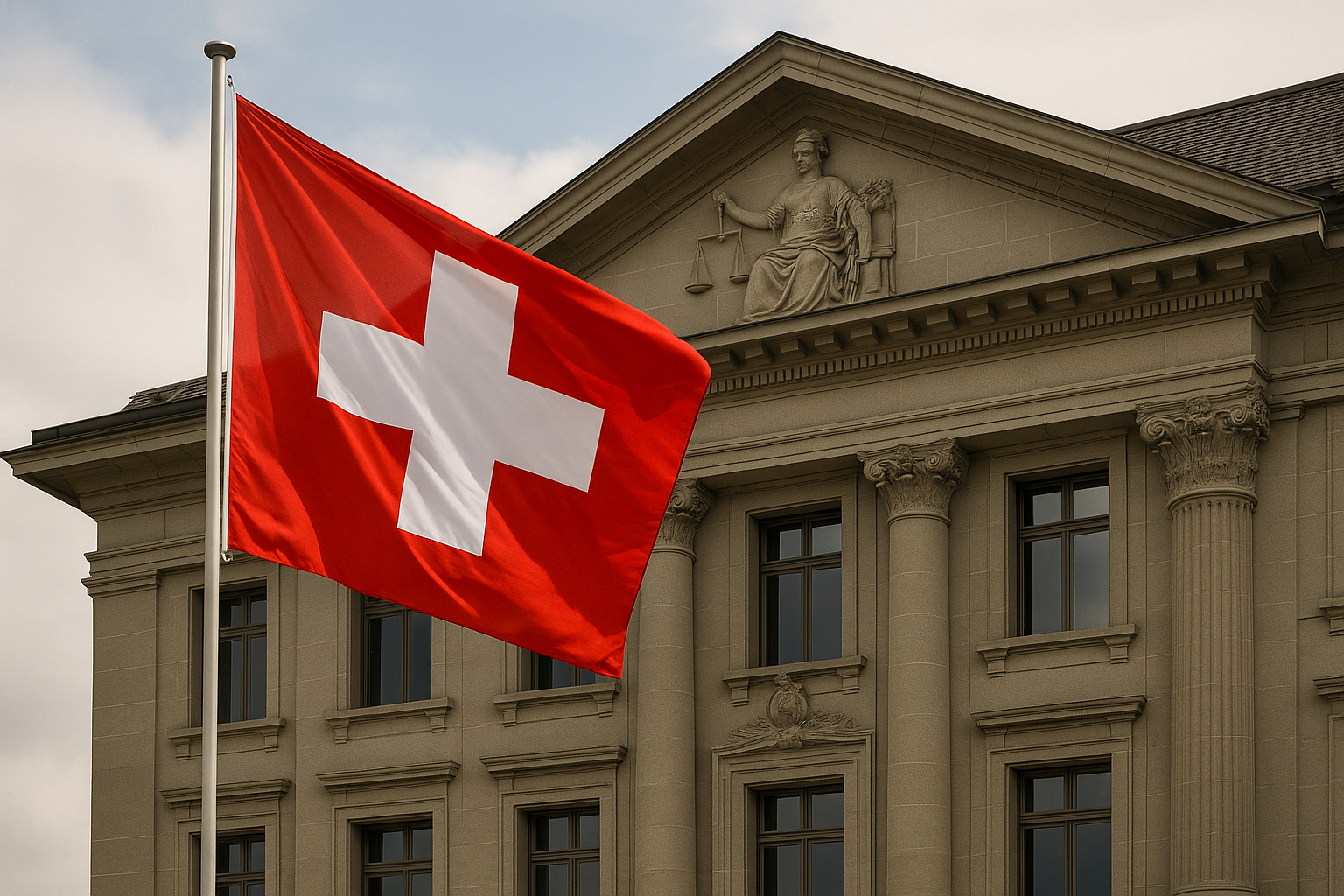

The Real Meaning of Swiss Banking Secrecy — From Asset Privacy to National Financial Security

The Origins and Purpose Behind Banking Secrecy

Swiss banking secrecy has long been associated with wealthy clients seeking privacy through numbered accounts and confidential asset management.

Yet the original purpose of Swiss banking secrecy extended beyond mere personal privacy. It was designed to safeguard Switzerland’s financial system, reinforce political neutrality, and maintain national and international trust in its legal and economic stability.

In essence, secrecy served as a structural pillar that protected not only individuals but also the integrity of the Swiss financial order.

Global Pressure and the Transformation of Secrecy

From the early 2000s onward, international efforts to combat tax evasion and money laundering triggered major changes in Switzerland’s banking environment.

New global reporting standards and enhanced cooperation among tax authorities made it difficult for Swiss banks to maintain unconditional anonymity for foreign clients.

Reforms in the 2010s further required banks to share specific information with foreign tax agencies under defined conditions.

As a result, Switzerland’s reputation as an unquestioned safe haven for hidden wealth was reshaped dramatically.

What Still Remains — Confidentiality and Stability

Despite these shifts, banking secrecy has not disappeared. Unauthorized disclosure of client information remains a criminal offense, and lawful clients continue to benefit from strong privacy protections.

For individuals in politically unstable regions or those exposed to currency volatility, Switzerland remains a highly attractive location for secure, rules-based wealth preservation.

The country’s reputation for regulatory integrity and financial professionalism continues to offer a sense of stability few jurisdictions can match.

What Investors Should Understand Today

Modern Swiss banking should be evaluated with realistic expectations:

Absolute anonymity no longer exists

International reporting standards are now the norm

Secrecy remains, but within a legal and transparent framework

Today, the focus has shifted from “hiding wealth” to protecting and managing wealth within a stable and reputable legal environment.

Rethinking “Safe Havens” in the Modern Financial World

While the era of unconditional secrecy has ended, Switzerland remains a credible and secure financial center.

Rather than relying on outdated myths, investors should understand current regulations and use Switzerland’s strengths — legal stability, transparency, and institutional trust — to build resilient wealth strategies for the future.

Dubai/UAE

Dubai/UAE

2025/12/10

The Shortest Route to Buying Al Dar Stock — ADX Account Access & “Bonds × Equities” Hybrid Strategy

Why Al Dar Properties Is Worth Your Attention Now

In recent years, Al Dar Properties has re-emerged as a leading candidate for the “next Emaar” in the UAE real-estate market. If you’re looking to buy their shares, the most critical requirement is a brokerage account that can access the listing exchange.

Al Dar shares are listed on the Abu Dhabi Securities Exchange (ADX). To trade them, you must open an account with a brokerage that supports ADX. Many standard brokerages you find in Japan or elsewhere handle U.S. or European stocks, but not necessarily securities from ADX. Therefore, choosing the right broker is the first essential step.

While almost any broker with ADX access lets you buy the same Al Dar stock, the differences lie in transaction costs, minimum deposits, usability of trading tools, and customer support. Ultimately, you want to minimize costs and maximize convenience.

A “Bonds × Equities” Hybrid Strategy — Combining Stability and Growth

A compelling, more nuanced approach is to build a hybrid investment strategy:

Start by investing in stable-income assets — for example, short-term government bonds.

Treat interest/dividends from those bonds as surplus cash flow.

Periodically use that surplus to purchase Al Dar stock.

This way, you maintain a stable income stream from bonds while positioning yourself for growth with real-estate equities. For long-term investors or those new to real-estate stock, this “stability + growth” approach can offer a balanced and sustainable path.

What to Keep in Mind Before Investing

Ensure you have a brokerage account with ADX access to trade Al Dar shares.

When selecting a broker, evaluate fees, deposit thresholds, available securities, and ease of use.

Consider combining equities with other assets (e.g. bonds) to prepare capital gradually.

Think long-term: focus on steady capital growth rather than quick speculation.

In a time of global economic uncertainty, a well-thought-out, diversified, and patient strategy can be more valuable than chasing short-term gains.

Looking Ahead — Why Al Dar Could Be the Next Big Real-Estate Player

Real-estate developers like Al Dar sit at the origin of supply chains for housing, commercial, and infrastructure developments. In the past, companies like Emaar captured massive growth, rewarding early investors.

Rather than treating those success stories as history, the current environment offers a chance to search for the next big opportunity. If you approach this investment with careful attention to regulatory frameworks, market conditions, corporate positioning, and disciplined capital planning, long-term value creation may be within reach.

Dubai/UAE

Dubai/UAE

2025/12/09

From ¥1 Million to ¥280 Million — The Astonishing Rise of Emaar and Where the Next Big Opportunity May Be

How a Small Investment Became a Massive Windfall

Since Dubai opened its real-estate market to foreign investors in 2002, the sector has expanded rapidly. Emaar has been one of the most prominent forces driving that growth.

If an investor had placed roughly ¥1 million (≈25,000 AED) into Emaar stock in 2002, that investment could now be worth over ¥280 million. Through stock splits and sustained growth, a holding of 25,000 shares would have increased to about 521,950 shares, valued around 7.1 million AED today.

That is a 284-fold return — achieved not by owning property, but by owning the company that creates the properties.

Why Developer Stocks Outperformed Direct Property Ownership

While many people focus on buying real estate directly, the real leverage often lies upstream — in the companies that acquire land, design projects, and build entire communities.

Emaar’s growth reflects the power of being positioned at the starting point of value creation. Real estate prices rarely increase hundreds of times, but companies driving urban development can grow exponentially in expanding markets.

The Leading Candidate for “The Next Emaar”: Al Dar Properties

For investors seeking similar long-term potential, Al Dar Properties in Abu Dhabi is emerging as a strong contender.

Reasons for investor attention include:

New opportunities from the liberalization of foreign ownership in Abu Dhabi

A strategic upstream position similar to Emaar’s early days

Robust capital backing from the government and oil revenues

Major growth capacity in upcoming urban developments

Al Dar may be positioned to lead the next wave of regional real-estate expansion.

Shifting Your Perspective: From Properties to Property Makers

Emaar’s example underscores the value of investing not only in real estate assets, but in the companies that shape the entire market.

A broader perspective — focusing on development capacity, business models, and market influence — may offer greater long-term returns than relying solely on rental income or short-term flips.

Key Takeaways for Strategic Investors

Identify companies with potential to replicate Emaar’s early growth

Prioritize the development pipeline and corporate growth over individual assets

Focus on long-term structural expansion rather than short-term gains

View real estate as an ecosystem, not just a collection of properties

Those who understand the mechanisms behind market growth may be best positioned to capture the next major opportunity.

2025/12/05

It’s Not Just Emaar — A Broader Downtrend Emerging in Dubai’s Real Estate Stocks

Understanding the Real Sentiment Behind Dubai’s Property Market

Emaar is often regarded as the symbol of Dubai’s real estate sector, and its stock price movements tend to be treated as a barometer of market sentiment.

However, focusing solely on Emaar provides only a partial view. Several other listed developers in the UAE play important roles in shaping the market, and their stock performance offers equally valuable insight into underlying trends.

A Wide Range of Developers Showing Declines

Key publicly traded developers in the UAE include:

Aldar Properties

Emaar Developments

Alpha Dhabi Holding PJSC

Modon Holding

Tecom PJSC

Deyaar Development

Rak Properties

Union Properties

These companies vary in scale and specialization but collectively form the backbone of the development pipeline across the region.

Recent observations show that many of them have experienced stock price declines simultaneously — a signal that the market may be undergoing deeper structural adjustments.

What the Downtrend Suggests About Upstream Market Dynamics

Real estate development begins far upstream: land acquisition, planning, and construction all precede the sales and leasing activities visible to end-users.

When developers — the drivers of this upstream process — see weakening sentiment, it can eventually ripple through the entire market.

A broad pattern of stock declines may indicate concerns about oversupply, slowing demand, or shifting buyer sentiment.

This means that anecdotal evidence of strong sales or profitable resales may not capture the full picture. Market fundamentals often reveal themselves earlier in corporate performance and stock valuations.

A Balanced View for Prospective Investors

Dubai's property market often draws attention for its momentum and high-profile developments. But like any real estate market, it follows cycles — and upstream signals should not be ignored.

For those considering entry into the Dubai market, the following perspectives can be valuable:

Track multiple developers rather than relying on one flagship company

Use objective indicators such as stock movements to assess sentiment

Understand how upstream dynamics shape future pricing and supply

Focus on long-term fundamentals rather than short-term speculation

A market surrounded by excitement requires an analytical mindset. Balanced, data-driven evaluation provides a more reliable foundation for decision-making.

Other/Investment

Other/Investment

2025/09/13

The Hidden Side of Dubai’s Property Market: How Low-Literacy “Flippers” Inflate Bubbles and Trigger Panic Selling

Introduction

Over the past few years, Dubai real estate has been so hot that deals can close with “a single phone call.” When short-term flippers with low investment literacy crowd into the market, prices tend to surge fast—and fall just as fast—creating a classic bubble → panic-selling cycle.

Reference post on X (Twitter): Account: https://x.com/MasaNozaki2 Thread: https://twitter.com/MasaNozaki2/status/1961312652178702745

This article clarifies common misconceptions, explains the market mechanics, and lays out principles you can actually operate by.

Assuming a purchase price of JPY 24,000,000 and annual rent of JPY 1,800,000:

Gross yield = 7.5%.

That is not the net yield.

Like Japan, Dubai properties incur maintenance and other running costs,

so the net yield will be lower.

https://twitter.com/MasaNozaki2

— Masa Nozaki (@MasaNozaki2), Aug 29, 2025

The Risky Pitch We Keep Hearing

“Because leases auto-renew, cash flow is predictable.”

It sounds neat, but auto-renewal alone doesn’t guarantee CF stability. Rent revisions, vacancies, service charges, capex, and rule changes can all shift your numbers.

We also see frequent confusion between:

Gross yield (rent ÷ purchase price), and

Net yield (after all costs and realistic vacancy).

Rule of thumb: the simpler the pitch, the more cautious you should be.

Change one assumption and your cash flow can break.

“One Phone Call for a $1M+ Deal”: Why It’s Scary—and Also an Opportunity

In a heated market, high-ticket deals can close with shallow due diligence. That’s scary, but it also creates opportunity when the cycle turns:

Risk: In a downturn, short-term flippers rush for the exit, flooding supply.

Opportunity: Forced selling often produces fundamentally undervalued prices.

How Bubbles Turn into Panic Selling

Early climb: Simple narratives (off-plan flips, pre-completion gains) attract capital.

Overheat: Social proof, success stories, easy money pull in short-term flows.

Trigger: Supply surge, rules/taxes, rates/FX moves, geopolitics.

Unwind: Crowded exit → inventory piles up → price resets → leveraged sellers dump.

Split: Prime, high-quality, rental-driven stock holds up; peripheral inventory sinks.

2027–2028: Watch the Supply Bulge

A high-supply pipeline in 2027–2028 is widely discussed. When supply lands, flippers’ exits narrow—an easy spark for panic selling.

This is a projection, and actual impact will depend on rates, FX, demand, and policy—i.e., a mix of factors.

Principles That Actually Protect You (Checklist)

Judge by earnings reality, not short-term momentum.

1) Evaluate yield on a net basis

Include service charges, maintenance/capex, taxes/fees, furniture, realistic vacancy, leasing costs, PM/agency fees, and platform fees (for STR).

2) Verify the quality of rental demand

Commuting nodes, schools, transit, retail.

Tenant tenure & profile (tourist-only demand is volatile).

Renewal clauses, break options, rent-review practice.

3) Test substitutability

If a flood of similar alternatives exists at the same price point, downside pressure is high—even in good locations if new supply walls are near.

4) Know your exit mechanics

Process and fees for foreign sellers, expected timing, buyer segments.

Track recent closed comps and list-to-close gaps.

5) Keep leverage disciplined

Model rate/FX stress (interest coverage, LTV, DSCR).

Understand loan covenants and your Plan B under stress.

Conclusion: Win with Design, Not Hype

Auto-renewal ≠ predictable cash flow.

Always value on net yield.

Build for multi-factor risk (supply, rates, FX, policy).

When the cycle turns, panic supply from flippers is likely—be ready to buy calmly and selectively.

Keep the decision tree simple:

Who rents? At what yield? For how long? Can I hold through a downturn?

If you can answer those with numbers, you’re playing the right game.

Other/Investment

Other/Investment

Other/Investment

Other/Investment

Dubai/UAE

Dubai/UAE

Dubai/UAE

Dubai/UAE

Other/Investment

Other/Investment