The Nigerian naira has shown resilience beyond many market expectations.

Traditionally associated with foreign exchange shortages and volatility, the currency’s recent stability suggests that deeper structural changes may be underway.

The unification of multiple exchange rate windows and increased transparency have improved market confidence.

Clearer policy frameworks reduce distortions and attract more stable capital inflows over time.

Stabilizing oil revenues and policy adjustments have supported foreign reserve levels.

High interest rates have also attracted portfolio investments, increasing demand for naira-denominated assets.

Monetary tightening aimed at controlling inflation has reinforced currency stability.

Higher interest rates discourage capital flight and enhance the relative attractiveness of local assets.

Increased oversight of foreign exchange transactions has reduced speculative pressures.

While tighter controls may limit short-term liquidity, they can contribute to exchange rate stability.

Currencies are influenced not only by fundamentals but also by expectations.

As confidence gradually returns, demand for precautionary dollar holdings may decline, supporting local currency strength.

The naira’s recent strength reflects a combination of policy reform, capital flows, and improved sentiment.

However, as an emerging market currency, it remains sensitive to external shocks and commodity price fluctuations.

Sustainability will depend on consistent policy implementation and continued improvement in external balances.

Nigeria’s currency story may be entering a new phase — but durability remains the ultimate test.

The USD/JPY exchange rate has experienced unusually sharp fluctuations in recent years.

While interest rate differentials and global economic conditions remain key drivers, domestic political developments have become increasingly influential.

As general elections approach, currency movements are no longer viewed as purely market-driven events, but as issues closely tied to political decision-making.

Ahead of elections, rapid currency movements can directly impact daily life through inflation, import costs, and energy prices.

As a result, excessive yen depreciation or appreciation quickly becomes a political issue, shaping public sentiment and government responses.

Currency intervention, therefore, serves not only as an economic tool but also as a political signal.

Markets constantly attempt to anticipate government and central bank actions by analyzing official statements and policy signals.

Authorities, on the other hand, balance verbal warnings, policy guidance, and the option of direct intervention to manage volatility.

As elections draw nearer, this interaction between policymakers and markets becomes increasingly delicate.

Sudden shifts in the exchange rate reflect more than short-term speculation.

They embody concerns about interest rate differentials, economic outlooks, and uncertainty surrounding policy responses.

Political events such as elections can amplify these factors, acting as catalysts rather than root causes.

During periods of heightened political attention, short-term market moves can appear dramatic.

Investors should step back and consider whether political events are temporary triggers or signals of deeper structural change.

Elections and interventions may influence timing, but they do not always alter the long-term direction of currency trends.

The interaction between elections and currency intervention highlights the close — yet limited — relationship between politics and financial markets.

Ultimately, markets return to fundamentals such as interest rates, growth prospects, and policy sustainability.

By looking beyond headlines and examining this balance, investors can gain a clearer perspective on what currency volatility truly represents.

The Common Reporting Standard (CRS) is an international framework that enables tax authorities to automatically exchange financial account information.

Its purpose is to prevent tax evasion through offshore accounts by ensuring transparency across borders.

A common misconception is that CRS allows governments to freely inspect all foreign bank accounts.

In reality, information exchange depends on several factors, including tax residency, participating jurisdictions, and account classifications.

CRS operates based on structured reporting rules, not indiscriminate monitoring.

Another frequent misunderstanding is the belief that holding accounts in non-CRS countries ensures privacy.

Even if a country is not formally participating in CRS, information may still be shared through bilateral agreements, bank compliance policies, or other international frameworks.

Relying solely on non-participation lists can create false security and unexpected risks.

CRS focuses less on where the account is located and more on where the account holder is tax resident.

Tax residency is determined by factors such as living arrangements, economic ties, and personal circumstances.

Changing account locations without changing tax residency rarely alters reporting obligations.

In the CRS era, the goal is not concealment but consistency and clarity.

Being able to explain why an account exists, how funds are sourced, and how income is reported is far more important than avoiding certain jurisdictions.

CRS may appear intimidating, but it is best understood as a baseline condition of modern international finance.

Rather than chasing perceived loopholes, individuals are better served by aligning their tax residency, account structures, and reporting obligations in a transparent and defensible manner.

This approach provides stability and confidence in a highly connected financial world.

Saudi Arabia has been accelerating its economic transformation in recent years.

As part of its strategy to reduce reliance on oil, the country is actively seeking foreign capital, expertise, and long-term partners.

One key initiative supporting this shift is the Golden Investor Visa, designed to offer long-term residency options to qualified foreign investors and professionals.

Unlike short-term visas, the Golden Investor Visa is built around long-term engagement.

It targets individuals who contribute directly to economic growth through investment, business activity, job creation, or specialized expertise.

The focus is not on residency for its own sake, but on fostering meaningful participation in Saudi Arabia’s evolving economy.

For investors, the visa offers more than extended stay rights.

Key advantages include long-term residency stability, easier family relocation, greater flexibility in managing investments or businesses, and reduced administrative burden from frequent renewals.

These factors allow Saudi Arabia to be viewed as a long-term base rather than a temporary investment destination.

Saudi Arabia is advancing large-scale initiatives across infrastructure, tourism, entertainment, and urban development.

Such projects require investors and executives who can commit over the long term and operate closely within the local environment.

The Golden Investor Visa supports this need by aligning residency policy with national development goals.

The visa is not universally accessible.

Eligibility depends on investment size, business activity, and compliance with evolving regulatory criteria.

Applicants should evaluate whether the program aligns with their strategic objectives rather than assuming it is a simple residency shortcut.

Saudi Arabia’s Golden Investor Visa reflects the country’s determination to integrate global capital and talent into its future.

Yet the visa itself is only a tool.

Its true value lies in how investors use it to build sustainable, long-term involvement in one of the region’s most ambitious markets.

In crypto investing, attention is often focused on price appreciation and potential gains. Yet experienced investors quickly realize that the real challenge lies elsewhere.

The most difficult question is not how to buy, but how to exit — how to convert digital assets into usable, real-world value.

Without a clear plan for where, how, and under which rules profits will be realized, even significant gains remain theoretical.

The complexity of crypto exits goes far beyond market volatility.

Different jurisdictions apply different regulations and tax treatments. Exchanges can change rules without notice. Banks may question or block incoming funds. Tax obligations often arise the moment profits are realized.

As asset values increase, these issues become more serious, making exit planning essential rather than optional.

What distinguishes ROMA’s approach is its focus on designing systems with exits in mind from the beginning.

Rather than emphasizing speculation alone, the framework considers:

This represents a shift from speculative crypto toward functional, usable digital value systems.

The crypto market is gradually moving from a speculative phase to one where usability, integration, and sustainability matter.

In this environment, assets that clearly define how value can be realized — legally and practically — gain credibility. ROMA’s direction reflects this broader maturation of the market.

For today’s crypto participants, the key questions are changing:

Success now depends not only on entry timing, but on having a clear and workable exit strategy.

Thinking about exits is a sign of serious, mature investing.

ROMA’s message is not about hype, but about connection — connecting digital assets to the real economy in a sustainable way.

As the crypto space evolves, projects that can clearly explain their exit pathways will stand apart from those that cannot.

When news breaks about investment fraud, attention often focuses on whether the perpetrators have been arrested. However, for victims, the real concern is far more practical: can the lost money be recovered?

In reality, even when criminals are arrested, victims frequently never see their funds again. This is because criminal prosecution and financial recovery are fundamentally different processes.

There are several reasons why recovering money from investment fraud is extremely challenging.

Fraudulent funds are often transferred rapidly across multiple accounts and jurisdictions. In many cases, cryptocurrencies or overseas financial institutions are used, making it difficult to trace the money.

Moreover, criminal investigations aim to establish guilt and impose punishment — not to return money to victims. Even a conviction does not guarantee compensation.

In addition, perpetrators often have no assets in their own names, or the money has already been spent, leaving victims with little or nothing to recover through civil claims.

One of the most common misconceptions is that arrest automatically leads to financial recovery. In truth, arrest is only the beginning.

Successful recovery depends on identifying where the funds went, who controls them, and whether legally recoverable assets still exist. As time passes, these possibilities diminish rapidly.

After discovering fraud, emotional reactions are understandable — but speed and realism are critical.

Victims should consider:

While recovery is not always achievable, doing nothing almost always worsens the outcome.

Investment fraud highlights a harsh reality: prevention is far more effective than post-damage response.

Skepticism toward “guaranteed returns,” unclear business models, and urgency-driven offers is essential. Understanding these warning signs remains the strongest form of protection.

In investment fraud cases, arrest may bring a sense of justice, but it rarely brings financial closure.

By understanding the limitations of recovery and responding calmly and quickly, individuals can minimize damage and make better decisions going forward. Knowledge, not hope, is the most reliable safeguard.

ECOWAS is a regional political and economic union formed in 1975 to promote cooperation among West African countries. Its initial mission was to create a unified economic space by reducing trade barriers and fostering cross-border commerce.

Over time, the organization expanded its scope to include political stability, peacekeeping, and security cooperation. It now plays a broader role in conflict mediation, election monitoring, and facilitating the free movement of people and goods.

Headquartered in Abuja, Nigeria, ECOWAS traditionally included 15 member states, though recent political developments have reduced active membership.

ECOWAS aims to strengthen regional economies through shared markets, infrastructure, and long-term strategies such as the introduction of a common currency, the ECO.

Alongside economic cooperation, ECOWAS has become a significant actor in regional security. It has intervened during periods of political instability, offering mediation and enforcing sanctions when necessary to uphold democratic principles.

In recent years, West Africa has experienced multiple coups and political crises. As a result, Mali, Niger, and Burkina Faso withdrew from ECOWAS and established a new alliance, the “Sahel Coalition,” signaling a major realignment in the region.

Their departure highlights tensions between ECOWAS’s governance principles and the political realities within certain member states. This shift has challenged the bloc’s ability to maintain cohesion and ensure regional stability.

At the same time, ECOWAS faces broader issues such as extremist violence, climate impacts, and economic disparities — factors that complicate its mission and test its resilience.

Nigeria, the region’s most populous and economically powerful nation, plays a crucial leadership role within ECOWAS. It supports peacekeeping operations, influences economic initiatives, and often acts as a mediator.

However, Nigeria’s own internal challenges mean that its stability — or instability — can significantly affect the entire West African region.

ECOWAS represents one of Africa’s most ambitious regional integration projects. Yet its future depends on balancing collective goals with the diverse political landscapes of its members.

To remain effective, ECOWAS will need to reinforce both economic integration and political stability, ensuring that cooperation continues despite mounting regional challenges.

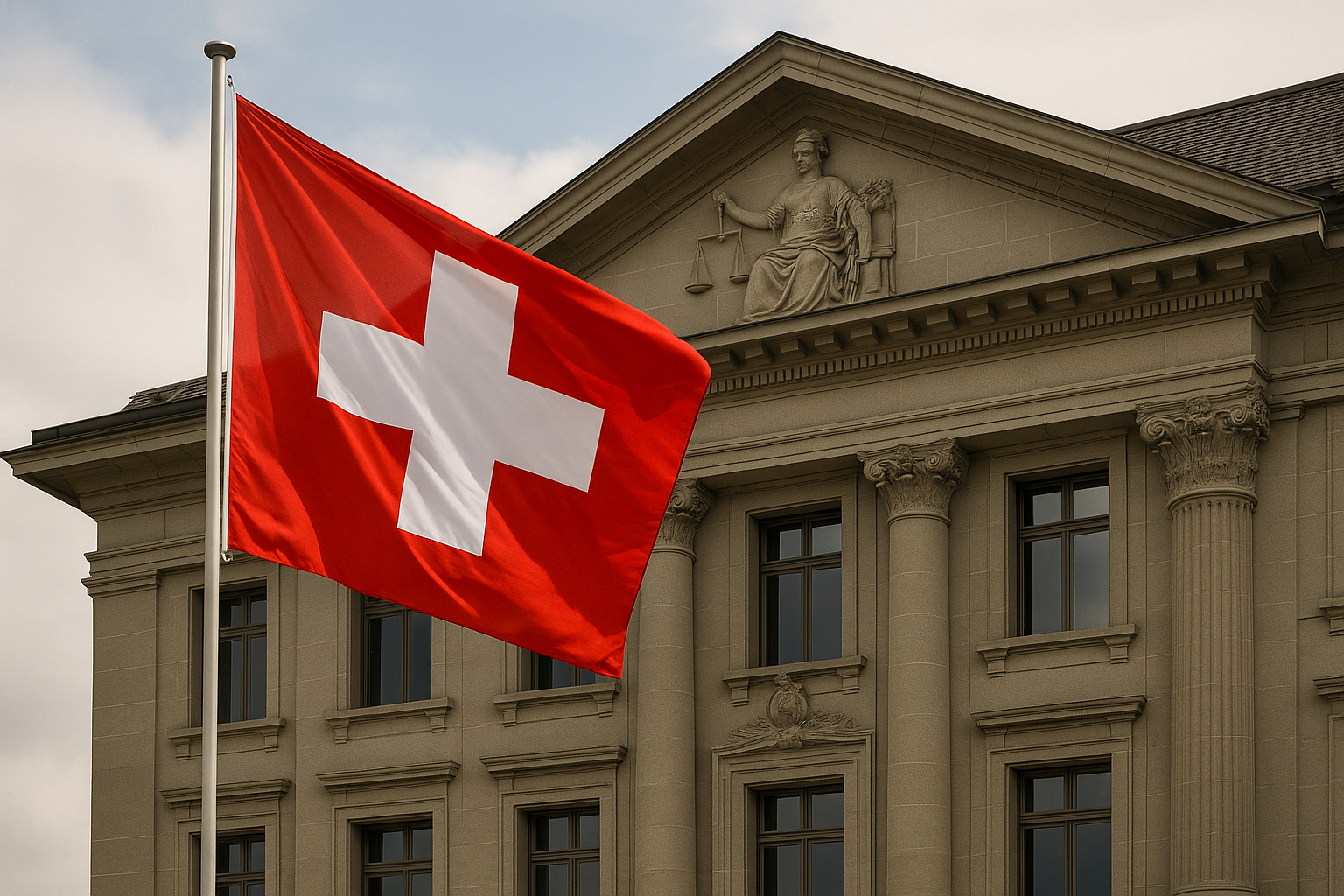

Swiss banking secrecy has long been associated with wealthy clients seeking privacy through numbered accounts and confidential asset management.

Yet the original purpose of Swiss banking secrecy extended beyond mere personal privacy. It was designed to safeguard Switzerland’s financial system, reinforce political neutrality, and maintain national and international trust in its legal and economic stability.

In essence, secrecy served as a structural pillar that protected not only individuals but also the integrity of the Swiss financial order.

From the early 2000s onward, international efforts to combat tax evasion and money laundering triggered major changes in Switzerland’s banking environment.

New global reporting standards and enhanced cooperation among tax authorities made it difficult for Swiss banks to maintain unconditional anonymity for foreign clients.

Reforms in the 2010s further required banks to share specific information with foreign tax agencies under defined conditions.

As a result, Switzerland’s reputation as an unquestioned safe haven for hidden wealth was reshaped dramatically.

Despite these shifts, banking secrecy has not disappeared. Unauthorized disclosure of client information remains a criminal offense, and lawful clients continue to benefit from strong privacy protections.

For individuals in politically unstable regions or those exposed to currency volatility, Switzerland remains a highly attractive location for secure, rules-based wealth preservation.

The country’s reputation for regulatory integrity and financial professionalism continues to offer a sense of stability few jurisdictions can match.

Modern Swiss banking should be evaluated with realistic expectations:

Today, the focus has shifted from “hiding wealth” to protecting and managing wealth within a stable and reputable legal environment.

While the era of unconditional secrecy has ended, Switzerland remains a credible and secure financial center.

Rather than relying on outdated myths, investors should understand current regulations and use Switzerland’s strengths — legal stability, transparency, and institutional trust — to build resilient wealth strategies for the future.

Over the past few years, Dubai real estate has been so hot that deals can close with “a single phone call.” When short-term flippers with low investment literacy crowd into the market, prices tend to surge fast—and fall just as fast—creating a classic bubble → panic-selling cycle.

This article clarifies common misconceptions, explains the market mechanics, and lays out principles you can actually operate by.

Assuming a purchase price of JPY 24,000,000 and annual rent of JPY 1,800,000:

Gross yield = 7.5%.

That is not the net yield.

Like Japan, Dubai properties incur maintenance and other running costs,

so the net yield will be lower.

— Masa Nozaki (@MasaNozaki2), Aug 29, 2025

“Because leases auto-renew, cash flow is predictable.”

It sounds neat, but auto-renewal alone doesn’t guarantee CF stability. Rent revisions, vacancies, service charges, capex, and rule changes can all shift your numbers.

We also see frequent confusion between:

Rule of thumb: the simpler the pitch, the more cautious you should be.

Change one assumption and your cash flow can break.

In a heated market, high-ticket deals can close with shallow due diligence. That’s scary, but it also creates opportunity when the cycle turns:

A high-supply pipeline in 2027–2028 is widely discussed. When supply lands, flippers’ exits narrow—an easy spark for panic selling.

This is a projection, and actual impact will depend on rates, FX, demand, and policy—i.e., a mix of factors.

Judge by earnings reality, not short-term momentum.

1) Evaluate yield on a net basis

Include service charges, maintenance/capex, taxes/fees, furniture, realistic vacancy, leasing costs, PM/agency fees, and platform fees (for STR).

2) Verify the quality of rental demand

Commuting nodes, schools, transit, retail.

Tenant tenure & profile (tourist-only demand is volatile).

Renewal clauses, break options, rent-review practice.

3) Test substitutability

If a flood of similar alternatives exists at the same price point, downside pressure is high—even in good locations if new supply walls are near.

4) Know your exit mechanics

Process and fees for foreign sellers, expected timing, buyer segments.

Track recent closed comps and list-to-close gaps.

5) Keep leverage disciplined

Model rate/FX stress (interest coverage, LTV, DSCR).

Understand loan covenants and your Plan B under stress.

Keep the decision tree simple:

Who rents? At what yield? For how long? Can I hold through a downturn?

If you can answer those with numbers, you’re playing the right game.

If you’ve ever looked into real estate investment in Abu Dhabi, you’ve likely come across Aldar, one of the most prominent names in the region.

Established in 2004 by the Abu Dhabi government and listed on the Abu Dhabi Securities Exchange since 2005, Aldar is widely regarded as the leading government-backed developer in the emirate.

In December 2021, Aldar acquired approximately 85.5% of Egypt’s major real estate developer SODIC, marking a strategic expansion into the largest market in North Africa.

Aldar is not alone in targeting Egypt. Emaar, the largest developer from Dubai, is already active in the Egyptian market, pushing forward major residential and commercial developments in Cairo and the New Administrative Capital.

This wave of investment by Gulf-based companies highlights the growing strategic interest in Egypt as a real estate and economic hub.

Egypt boasts a population of over 100 million, making it the most populous country in the MENA (Middle East and North Africa) region.

The MENA market is united by shared language (Arabic) and culture (Islam), and is expected to grow into a region of 550 to 800 million people. Within this, Egypt stands out for:

Beyond developers, governments and financial institutions from the Gulf are also eyeing Egypt.

This month, the Deputy Ruler of Sharjah paid an official visit to Egypt’s New Capital, signaling a broader UAE interest in Egyptian development.

Such high-level engagements suggest that Egypt will continue to attract significant foreign capital in the coming years.

With a massive population, ambitious infrastructure projects, and increasing foreign interest, Egypt’s real estate sector is fast becoming a focal point for MENA investors.

For investors seeking long-term growth opportunities in emerging markets, understanding Egypt’s strategic importance is now essential.

Please feel free to contact us from the email form.